EPF Form 10D: The 2026 Guide to Claiming Your Monthly Pension

- Buragadda Praneet

- Jan 9

- 6 min read

Updated: Feb 21

Retirement planning does not end with saving it culminates in converting those savings into a stable, lifelong income. For members of the Employees’ Pension Scheme (EPS), that transition happens through Form 10D. While many employees are familiar with withdrawing their Provident Fund balance, far fewer understand how to activate their monthly pension entitlement correctly.

Form 10D is the official application used to start your EPS monthly pension after meeting the required service and age conditions. Unlike lump-sum withdrawals, this form establishes a recurring income that continues for life and extends financial protection to your spouse and eligible children after you. Because it determines your long-term retirement security, filing it correctly is critical.

This guide explains who is eligible, the difference between Form 10C and Form 10D, early vs. superannuation pension rules, the 2026 updates under the Centralised Pension Payment System (CPPS), the online and offline application process, common rejection reasons, and what happens after approval. Whether you’re nearing retirement or planning ahead, understanding Form 10D ensures your years of service translate into dependable monthly income.

Table Of Contents

What Is Form 10D in EPF?

Form 10D is the application form used to claim a Monthly Pension under the Employees’ Pension Scheme (EPS). Unlike PF withdrawal (Form 19), which is a one-time lump sum, Form 10D sets up a recurring income that pays you until death (and covers your spouse after that).

The Critical Difference: Form 10C vs. Form 10D

Many people file the wrong form and get rejected. Here is the simple rule:

Feature | Form 10C (Withdrawal/Certificate) | Form 10D (Monthly Pension) |

Purpose | Withdraw cash or preserve service. | Start monthly income. |

Eligibility | Service < 10 Years (for cash). | Service ≥ 10 Years. |

Timing | Any time after leaving a job. | Usually at Age 58 (Retirement). |

Payout | One-time Settlement. | Monthly for life. |

When Can You Use Form 10D? (Eligibility Rules)

You cannot just "choose" to take a pension. You must unlock it by meeting two specific criteria:

1. The Service Rule

You must have completed at least 10 years of eligible service.

Note: If you worked for 9 years and 6 months, the EPFO rounds it up to 10 years, making you eligible.

2. The Age Rule

Case A: Superannuation Pension (Age 58)

This is the "Full Pension." You retire at 58 and get 100% of your calculated pension amount.

Case B: Early Pension (Age 50–57)

You can opt for an early pension, BUT there is a catch. Your pension amount is reduced by 4% for every year you are younger than 58.

Case C: Disablement Pension

If you are permanently disabled and can no longer work, you are eligible for a pension immediately, even if you haven't completed 10 years of service.

2026 Update: The Centralised Pension Payment System (CPPS) is now live. Your pension is no longer tied to a specific bank branch. You can receive your pension in any Aadhaar-linked bank account anywhere in India without transferring your PPO.

If your service is below 10 years, read our complete Form 10C guide instead

Verify your EPS service years before applying to avoid rejection

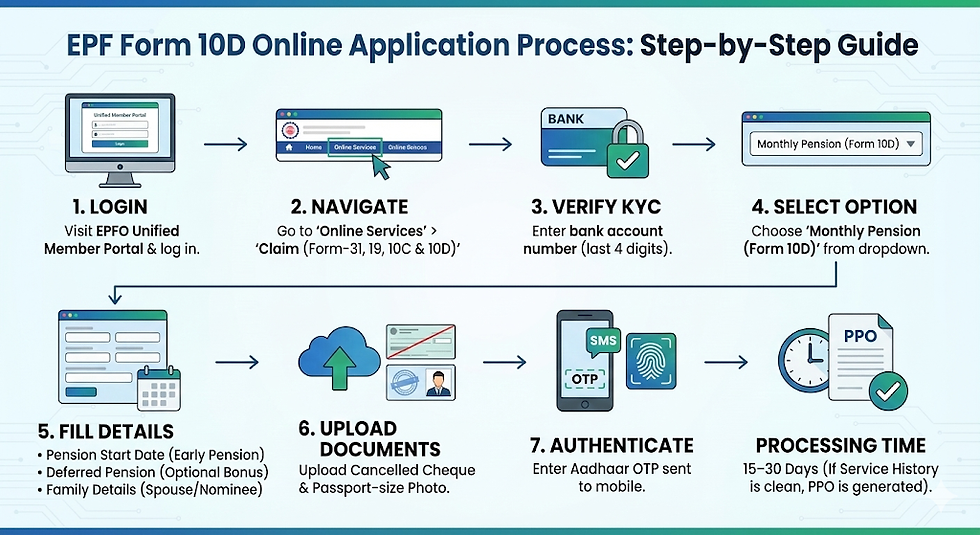

How to Apply for Form 10D Online

The digital process is now seamless, provided your data is clean.

Login: Visit the EPFO Unified Member Portal and log in.

Navigate: Go to Online Services > Claim (Form-31, 19, 10C & 10D).

Verify: Enter your bank account number (last 4 digits) to verify KYC.

Select Option: In the dropdown, select "Monthly Pension (Form 10D)".

Fill Details:

Pension Start Date: (If applying for Early Pension).

Deferred Pension: (If you want to delay pension after 58 for a 4% bonus).

Family Details: Ensure spouse and nominee details are visible.

Upload: You may need to upload a cancelled cheque and a passport-size photo.

Authenticate: Enter the Aadhaar OTP sent to your mobile.

Processing Time:

If your Service History is clean, the PPO (Pension Payment Order) is usually generated within 15–30 days.

PF Portal Login Issues in 2026: Common Problems, Easy Fixes

Form 10D Offline Submission

(For Death Cases or Old Accounts)

If you are a nominee claiming a Widow/Child Pension, or if your Aadhaar isn't linked, you must use the physical route.

Documents Required:

Filled Form 10D (signed by the claimant).

Descriptive Role: A specific form with photos and signatures of all family members.

Joint Photos: 3 passport-size photos of the member and spouse.

Bank Passbook: Copy showing the Joint Account (Member + Spouse).

Aadhaar & PAN: For all claimants.

Date of Birth Proof: For children (if claiming Child Pension).

Where to Submit?

Submit it to the Regional PF Office where the member’s account was last maintained.

Strategic Advice: Should You Take "Early Pension"?

Just because you can take a pension at age 50 doesn't mean you should.

The "4% Loss" Trap:

If you start your pension at age 50 (8 years early), your pension is reduced by 32% (4% x 8 years). This reduction is permanent. You will get 32% less every month for the rest of your life.

Recommendation: Unless you have a financial emergency, wait until 58 (Superannuation) to claim the full amount.

The "Deferred Pension" Bonus:

If you continue working after 58 and don't claim a pension until age 60, the EPFO gives you a 4% bonus for each deferred year.

Top 3 Reasons Form 10D Gets Rejected

Rejection at this stage is painful because it delays your monthly income.

Service Gaps (Non-Contributory Period):

If your employer marked "Absent" days but didn't report them correctly, the system might calculate your service as less than 10 years.

Solution: Check your service history first. If gaps exist, file a Joint Declaration to fix them.

Bank Account Mismatch:

For a pension, the bank account must be either a single account or a joint account with the spouse. Joint accounts with children or parents are often rejected.

Family Details Missing:

If your spouse’s name isn’t in the EPF database, the claim will fail (because Widow Pension logic requires it).

Solution: Update your e-Nomination before filing Form 10D.

Explore

EPF Date Overlap Problems: Fix Date of Exit & Joining Errors

What Happens After Approval? (The PPO)

Once approved, you don't just get money; you get a PPO (Pension Payment Order) number.

Keep this number safe. It is your Pensioner Identity.

Jeevan Pramaan: Every year in November, you must submit a Digital Life Certificate using this PPO number to prove you are alive and continue receiving the pension.

Final Thoughts on Form 10D

Filing Form 10D is the final act of your career's financial journey. It transitions you from a "Saver" to a "Receiver."

While the paperwork might feel heavy, remember that this is a lifetime benefit. Take a week to ensure your Service History is perfect and your Family Details are updated. A clean application today ensures a peaceful, regular income for decades to come.

Frequently Asked Questions (FAQs)

Q: Can I work and receive a pension at the same time?

A: Yes, but only if you are working in a company not covered by EPF, or if you have already crossed the age of 58. If you take an Early Pension (age 50-57) and rejoin an EPF-covered job, your pension will be suspended until you retire again.

Q: What is the minimum pension amount?

A: Currently, the minimum pension is ₹1,000 per month, provided you are eligible. (Note: Discussions are ongoing to increase this limit in the future.

Q: My service is 9 years and 2 months. Can I pay extra to complete 10 years?

A: No. If you have less than 9.5 years of service, you are not eligible for a pension. You must withdraw the corpus using Form 10C.

Q: What happens if the pensioner dies?

A: The pension automatically shifts to the Spouse (Widow/Widower Pension) and up to two children (until they turn 25). The family must report the death to the bank/EPFO to switch the beneficiary.

Q: Is the monthly pension taxable?

A: Yes. Unlike the lump sum PF withdrawal (which is tax-free after 5 years), the Monthly Pension is fully taxable as "Salary Income" based on your tax slab.

Disclaimer: This guide is for educational purposes and based on the rules applicable in 2026. EPF rules are subject to change by the government. For specific legal or financial advice, consult a professional.

Comments