EPF Form 11: Joining & PF Declaration Guide (Download, Sample, How to Fill)

- Jayshree Gupta

- Dec 23, 2025

- 7 min read

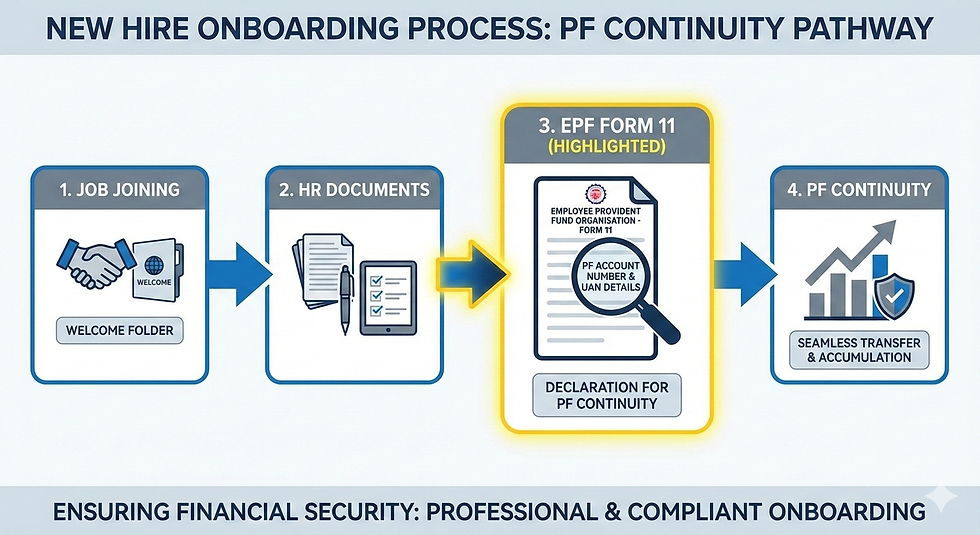

EPF Form 11 is the declaration every employee must submit when joining a new job to link their UAN, PF balance, and EPS service correctly.

TL;DR: Your EPF Form 11 Essentials

What it is: A mandatory declaration form submitted when you join a new organisation covered under EPF.

Why it matters: It ensures continuity of your Provident Fund (PF) balance and Pension (EPS) service history across jobs.

Critical detail: If you have worked earlier, providing your correct UAN is non‑negotiable.

Risk of neglect: Even a small mismatch can result in duplicate UANs, frozen balances, or missing pension years.

Best practice: Fill Form 11 on Day 1 and ensure every detail matches your Aadhaar records exactly.

Your First Day Shouldn’t Be About Paperwork Stress

Starting a new job in India is often a mix of excitement and anxiety. You’re learning new systems, meeting colleagues, understanding expectations - and at the same time, you’re handed a stack of HR documents that all seem urgent. Among them sits EPF Form 11, usually presented as a routine formality.

At Kustodian, we work closely with employees and families across India who discover - often years later - that a small oversight on this form created long‑term problems. A missing UAN, an incorrect date of exit, or a name mismatch may not cause any immediate issue. But when the time comes to withdraw PF, transfer funds, or claim pension benefits, these errors surface as rejections, delays, and endless follow‑ups with employers and EPFO offices.

This guide is meant to slow the process down. Instead of rushing through Form 11, we’ll help you understand why it exists, how it flows through the EPFO system, and how to fill it correctly the first time, so your savings move with you seamlessly throughout your career.

Free EPF Audit

Changed jobs before? A quick audit can identify duplicate UANs, missing exit dates, or broken EPS history before they cause problems.

1. What Is EPF Form 11, and Why Does EPFO Require It?

EPF Form 11 is officially titled “Declaration by a person taking up employment in an establishment in which the Employees’ Provident Fund Scheme is applicable.”

In practical terms, it is a legal declaration you make to your new employer stating:

Whether you were previously a member of the EPF scheme.

Your identity and KYC details as per government records.

Your employment and PF history so that your accounts can be linked correctly.

From EPFO’s perspective, Form 11 serves one core purpose: preventing fragmentation of your PF and pension records. Without this declaration, employers may inadvertently create a fresh PF identity for you, breaking your service history and causing long‑term complications.

Quick PF Check (Free): If you’ve changed jobs even once before, there’s a chance your PF service history is fragmented or partially linked. A quick review at this stage can help spot duplicate UANs or missing records early.

2. When Is EPF Form 11 Required?

You are required to submit Form 11 in the following situations:

When changing jobs: Every time you join a new EPF‑covered organisation.

First job: To confirm that you have never been a member of EPF and to initiate UAN generation.

International workers: For foreign nationals working in India or Indian employees returning from SSA countries.

Exempted establishments: Even if your employer manages PF through a private trust, Form 11 is mandatory for EPS tracking.

In short, if EPF applies to your employment, Form 11 applies to you.

3. How to Fill EPF Form 11 Correctly (Section-by-Section)

EPF Form 11 is divided into three logical sections, each serving a specific compliance purpose.

Part A: Personal Information

This section establishes your identity in the EPFO system.

Name of the Member: Must exactly match Aadhaar (no initials or abbreviations).

Father’s / Spouse’s Name: Preferably as per Aadhaar records.

Date of Birth: Any discrepancy here affects EPS eligibility later.

Gender: Select accurately.

Mobile Number: Use the Aadhaar‑linked number for OTPs and alerts.

Email ID: Always provide a personal email, not a work ID.

Part B: Previous Employment Details (Most Critical)

This section determines whether your past PF service is carried forward.

If you have worked before, you must provide:

Universal Account Number (UAN): 12‑digit number allotted earlier.

Previous Member ID: Available on salary slips or UAN portal.

Date of Exit: Last working day with the previous employer.

Scheme Certificate Number: Only if issued (rare).

PPO Number: Only if you are already drawing a pension.

Leaving this section incomplete is the most common reason for PF transfer failures.

Part C: KYC Information

Accurate KYC ensures smooth withdrawals and tax compliance.

Bank Account Number & IFSC: Ensure IFSC reflects post‑merger codes.

Aadhaar Number: Mandatory for almost all EPF services.

PAN: Essential for tax‑free withdrawals above ₹50,000.

Kustodian Insight: If your HR team suggests skipping previous employment details or creating a fresh PF record, pause. This is one of the most common reasons PF transfers fail later. Verifying your UAN and exit status before submission can prevent long-term issues.

In short, Form 11 decides whether your PF and pension follow you across jobs or get fragmented.

If your PF feels stuck or confusing, you’re not alone. Many employees face delays due to employer non-response or incomplete records. Speak to a specialist who understands the EPFO process.

4. How Employers Process Form 11 (2025 Workflow)

With digitisation, the employer’s role has evolved significantly.

Online Process

Most medium and large organisations use HRMS platforms. Employees enter details digitally, which HR verifies and uploads to the EPFO portal using a Digital Signature Certificate (DSC).

Offline Process

Smaller establishments may still use physical forms. In such cases:

You sign Form 11.

Employer verifies and stamps it.

Data is manually uploaded to EPFO.

UAN Generation Update

As per the 2025 rules, Aadhaar‑based Face Authentication via UMANG is required to generate a new UAN, reducing duplicate accounts.

This workflow is based on current EPFO operational practices observed across HRMS systems and regional EPFO offices as of 2025.

5. Common EPF Form 11 Mistakes (And Their Long-Term Impact)

We regularly see cases where a missing exit date blocks PF transfers for 12–18 months, even though monthly deductions continue.

Mistake | Immediate Issue | Long‑Term Consequence |

Incorrect UAN | Duplicate account | Funds split across UANs |

Name mismatch | Aadhaar seeding failure | Monthly contributions rejected |

Missing exit date | Transfer failure | PF stuck with old employer |

Wrong EPS declaration | Service reset | Pension eligibility loss |

These errors rarely surface immediately—but when they do, resolution can take months.

Preventive Tip: PF login errors, rejected claims, or missing service periods are often early signs of Form 11 or UAN linkage issues. Addressing them now is far easier than correcting them years later.

If you’re unsure whether your PF records are clean, it’s worth checking early — before you actually need the money.

6. Real‑World Indian Challenges You Should Know

Joint Declaration Delays: Corrections often require signatures from past employers who may be unresponsive.

58‑Year EPS Rule: Incorrect DOB can extend or shorten pension contributions wrongly.

Bank Mergers: Outdated IFSCs remain a leading cause of withdrawal rejections.

7. Form 11 vs Other EPFO Forms

Form | Purpose | Usage |

Form 11 | Joining declaration | At the time of joining |

Form 13 | Transfer PF | After Member ID creation |

Form 19 | PF withdrawal | After exit |

Form 10C | EPS withdrawal | Service <10 years |

Understanding this distinction prevents misfiling and delays.

8. Frequently Asked Questions

Do I need Form 11 if I already have a UAN?

Yes. EPF Form 11 is mandatory even if you already have a UAN. It is the declaration that legally links your existing UAN to your new employer in the EPFO records.

What if my previous employer hasn’t marked my exit?

You can still submit Form 11, but your PF transfer will fail until the previous employer updates the exit date. This is one of the most common reasons PF transfers get stuck.

Is Form 11 mandatory for excluded employees?

Yes. Even if you are classified as an excluded employee (above wage limit or opting out), Form 11 must be submitted to record the declaration with EPFO.

Can freelancers use Form 11?

No. EPF Form 11 applies only to employees joining an organisation covered under the EPF Act. Freelancers and self-employed individuals are not eligible.

What happens if I don’t submit EPF Form 11?

If Form 11 is not submitted or filled incorrectly, your employer may create a duplicate PF record. This can break your service history and cause problems during PF transfer, withdrawal, or pension claims later.

Is EPF Form 11 mandatory for first-time employees?

Yes. First-time employees must submit Form 11 to declare that they were not previously a member of EPF. This allows EPFO to generate a new UAN correctly.

Can I correct mistakes in EPF Form 11 later?

Yes, but corrections often require a joint declaration and cooperation from current or past employers. Fixing errors later can take months, which is why accuracy at the time of joining is critical.

What is the biggest mistake employees make with EPF Form 11?

Leaving previous employment details blank or incorrect. This often leads to duplicate UANs, failed PF transfers, and pension eligibility issues years later.

9. Final Thoughts: Why Form 11 Deserves Your Attention

EPF is not just a deduction on your salary slip—it is a regulated, long-term social security system designed to protect you during job loss, medical emergencies, and retirement. Pension eligibility, tax-free withdrawals, and financial continuity all depend on one thing: clean and complete EPFO records.

Most PF issues we see at Kustodian are not caused by fraud or intentional non-compliance. They originate from small data gaps created during job transitions—missing exit dates, mismatched names, or unlinked UANs. EPF Form 11 is the first and most important checkpoint to prevent these issues.

Taking a few extra minutes to verify this form at the time of joining can save you months—or even years—of follow-ups later.

Clarity today protects your stability tomorrow.

Kustodian Note: Before submitting Form 11, it is advisable to review your past PF and EPS records for mismatches, inactive accounts, or unlinked service history. Early detection makes corrections significantly easier.

Final Step: Secure Your EPF Records Before They Cost You Time

EPF and pension issues usually surface when people need their savings the most—during job loss, medical emergencies, or retirement. By then, correcting missing records or broken service history can be stressful and time-consuming.

At Kustodian, we help employees across India:

Identify duplicate or inactive UANs

Trace PF balances from past employers

Verify EPS service history and exit dates

Resolve data mismatches before claims are rejected

📞 Book a 20‑minute advisory call if your PF transfer is stuck, your withdrawal was rejected, or your service history is incomplete.

Most employees don’t make mistakes because they are careless — they make them because no one explains how EPFO systems actually work.

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice. EPFO rules and interpretations may change. Always verify with official EPFO notifications or consult a qualified professional.

Comments